Next-generation trading platforms are much more than just technical infrastructure. They form the digital backbone of future-proof securities trading and modern, analytics-based financial services. The market is placing increasingly high demands on these platforms: rapidly growing use of digital channels for trading ETFs and securities, a sustained influx of private investors, and rising expectations in terms of availability, performance and user experience. Against this backdrop, banks and financial service providers are faced with the task of further developing their system and trading architectures, both technologically and organisationally.

Powerful platform solutions, complemented by innovative technologies such as artificial intelligence and data-based business models, create sustainable cost advantages, increase operational efficiency and form the basis for customer-centric offerings. At the same time, they open up new opportunities for flexible products, shorter go-to-market times and highly automated end-to-end processes.

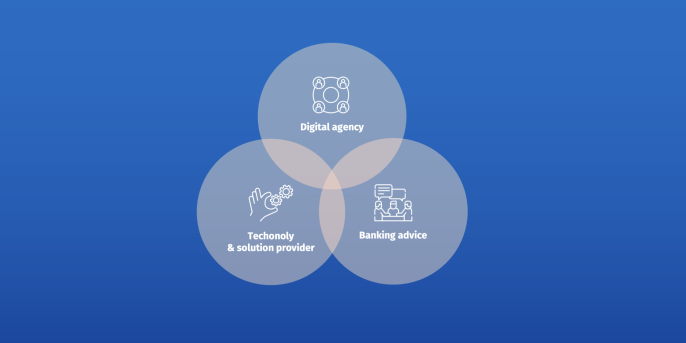

We support financial service providers in aligning their solutions in the securities business specifically towards growth, scalability and compelling customer experiences – from strategic goal definition and modern architecture concepts to secure and efficient operation.