3. February 2026 By Alexej Schwed

The Digital Euro 2026: What decision-makers need to know now

Background: I participated in the ECB focus session on the pilot on 15 January 2026. The key points (pilot scope, use cases, timelines, PSD2 framework) are integrated into the decision-making roadmap below.

Executive Briefing (in 60 seconds)

Timeframe: The ECB will publish the ‘Call for Expression of Interest’ in March 2026 and select suitable PSPs for the 12-month pilot (real-world transactions in a controlled environment) from H2 2027 onwards. A possible initial issue is conceivable from 2029 onwards, provided that the Digital Euro Regulation is adopted in 2026.

Pilot scope: four use cases – P2P alias (online), P2P NFC (offline), P2B SoftPOS (in-store) and P2B e/mCommerce (online) – with approximately 5,000 to 10,000 internal end users from the Eurosystem and 15 to 25 merchants. The DESP (Digital Euro Service Platform) provides central functions (including tokenisation, alias components, settlement layer, reference app/SDK), while the PSPs deliver the front and back end.

Legal situation in the pilot: Settlement takes place as a Eurosystem liability in book form under PSD2 (not legal tender, but close to the target).

2026 is a decision year: Decision map for banks & PSPs

Three fundamental strategic decisions

1. Pilot participation yes/no?

- Yes: Early access to DESP/rulebook realities, co-design of UX, fraud and offline processes, accelerated certification and investment in integration, testing and support.

- No: There is no pilot burden, but a higher integration/time-to-market risk for 2027/28 and less influence on fee capping/processes. Regulation will come regardless.

2. Build vs. buy vs. hybrid for app/SDK, alias, fraud services

- DESP provides key building blocks. Front-end/customer journeys and fraud intelligence can be market differentiators – but only if the architecture and sourcing decisions are made by 2026. Fees/compensation logic: How do banks earn money – under caps?

- The draft provides for compensation for PSPs and a cap for merchants. Those who calculate model variants and design value-added services (e.g. identity, loyalty and data services) now can reduce margin pressure.

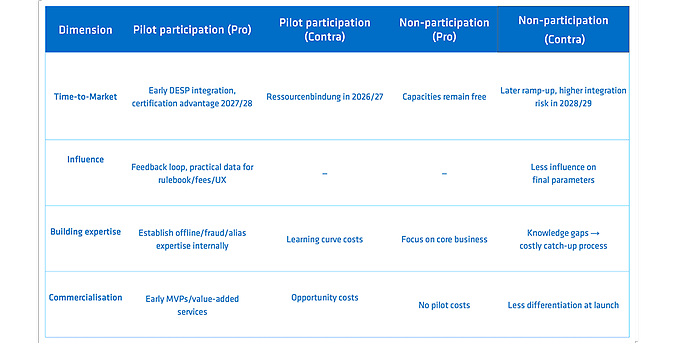

What does participating vs. not participating mean (2026–2029)?

Agenda 2026 by role: What needs to be on the table now?

Board and management (bank/PSP)

- 1. Pilot go/no-go and scope (March–May): Decision on participation, choice of role (distributing/acquiring or both) and a budgeted roadmap until H2 2027.

- 2. Operating model: ‘Digital Euro’ unit (PMO, compliance, technology, product, risk) with mandate for DESP integration, backend certification and support processes.

- 3. Revenue model under caps: Scenario calculation issuer/acquirer; examine ‘Digital Euro as a Service’ for third-party institutions/merchants.

Head of Payments / CIO / CTO

- 1. Architecture decision (Q2): Build/buy/hybrid for app/SDK, alias, risk/fraud; definition of interfaces to DESP.

- 2. Offline readiness: Device certificates, local settlement, re-sync processes, test automation, fraud models for offline flows.

- 3. Certification and testing: Backend certification path, user tests for the four pilot use cases (alias, SoftPOS, e-commerce/m-commerce, P2P NFC).

Product manager/sales

- 1. Journeys and UX: Development of frictionless flows (e.g. Tap to Phone, Alias Pay) with clear communication of benefits (data protection, resilience, ‘always accepted’).

- 2. Merchant value proposition: Cost/benefit under fee capping; plan POS and checkout enablement (SoftPOS, gateway updates).

- 3. Segment go-lives: Select employees/retailers for the pilot in a targeted manner (use case fit, support capability, feedback quality).

Digitalisation in finance

Creative services and tailor-made solutions for sustainable business models

As a creative and reliable service provider for banks, we take responsibility and stand by your side as your partner. Our solutions combine technology, expertise and methodology to create individual customer experiences. We see ourselves as an end-to-end service provider for sustainable business models, delivering tailor-made solutions and integrating powerful standard software.

Technology and security: What the pilot should reliably clarify

- DESP and interoperability: A uniform infrastructure (tokenisation, alias, settlement, app/SDK) forms the basis. The PSPs provide distribution and user experience. It is a scheme-based model with open standards (including CPACE).

- Data protection logic: Online data minimisation (AML required), offline → cash-like confidentiality. The pilot provides practical data on fraud prevention without central profile creation.

- Offline limits: Double spend protection, certificate/device trust, hop limitations and re-funding: High effort, but crucial for resilience. Accordingly, the offline component was given high priority.

Regulatory path and fees: What is fixed, what remains open

- Legislation and timetable: The regulation is scheduled to be finalised in 2026, with pilots set to start in 2027 and the first issue planned for 2029, depending on legislative progress.

- Fees/compensation: Caps in favour of merchants, appropriate compensation for PSPs; market positions diverge (merchants are demanding very low caps, while acquirers warn of undercompensation). Pilot data is central to calibration.

For merchant and acceptance networks: Why early participation is worthwhile

- Acceptance as a ‘common layer’: DESP creates a Europe-wide acceptance layer that overcomes national isolated solutions. The first productive journeys include SoftPOS and e/m-commerce flows.

- Costs and transparency: Caps can make payment acceptance more predictable, but only if the POS/gateway roadmap starts in 2026 and fee reporting is prepared.

Risks and countermeasures (brief and practical)

- Integration delay: The countermeasure is the 90-day ‘Golden Path’ plan for each use case with early test data. Participation in the pilot serves as ‘risk insurance’.

- Offline fraud risks: Device trust framework, limit logic for offline amounts/hops, hybrid detection (on- and off-device).

- Margin pressure: Countermeasures include fee scenarios, value-added services and bundles with identity/loyalty functionalities.

Social dimension: User focus, acceptance drivers, myth busting

User research and inclusion:

The ECB addresses the needs of different groups (small retailers, particularly vulnerable users) and tests clear, frictionless journeys (Alias, Tap to Phone, eCom). The pilot is designed to be realistic (everyday purchases at 15–25 retailers, real transactions) but controlled (closed user group).

Classification of common misconceptions:

- ‘The digital euro will replace cash.’ – False. Cash will remain legal tender and will be supplemented by the digital euro. The ECB and federal institutions emphasise coexistence and have passed corresponding legislation to protect cash.

- ‘The ECB sees every payment.’ False. Offline: Cash-like confidentiality (only payer/payee). Online: strict data minimisation; intermediaries only see the data necessary for anti-money laundering purposes, not the ECB.

- ‘Programmed compulsory payments/exclusions.’ False. The ECB excludes ‘programmability’ in the sense of usage restrictions for base money. Value-added services (such as conditional payments) are up to market participants – voluntary and regulated.

- ‘Launching soon; we'll be paying with it by 2026.’ Unlikely. Realistic path: legal framework in 2026, pilots from 2027, potential issuance in 2029.

Conclusion: 2026 will determine influence and speed – 2027 will provide evidence

Those who decide, invest and integrate in 2026 will determine the utility, costs and speed of their own digital euro offering in 2027/28 – instead of being reactive in 2029.

Participation in the pilot project is not an end in itself, but rather insurance against integration and reputation risks with a real influence on the fine-tuning of the regulatory framework, fee calibration and UX standards.

We support you!

The digital euro is not an isolated IT project, but rather an interplay of regulation, payment transaction architecture, product design and operating models. adesso accompanies banks and payment service providers throughout the entire decision-making and implementation process – from strategic classification to technical pilot capability.