Legal requirements, social acceptance and ethics are hurdles in the use of artificial intelligence. In no other service industry is the customers’ need for protection, trust and security as pronounced as in the insurance industry. The transfer of risk means that the policy holder depends on the insurer’s promise of protection in the event of a claim.

Transparency regarding why certain decisions are made is therefore a top priority in the insurance industry.

XAI – explainable AI – can pave the way for building artificial intelligence solutions suitable for the insurance industry.

XAI explains the past, present and future actions of artificial intelligence. In short, XAI is about maximum transparency. What’s more, AI-based decisions can be made tangible.

Check out our quick check

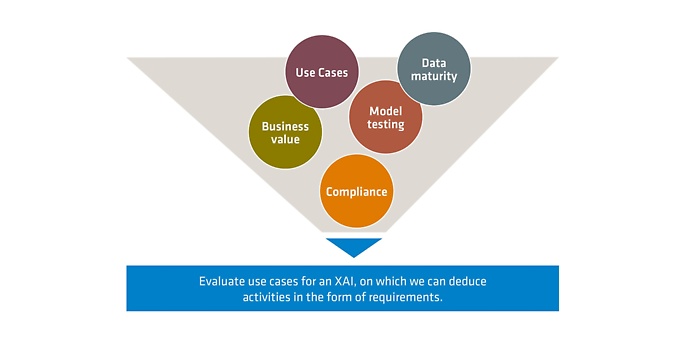

We offer to take a look at the different dimensions of your insurance processes (professional, technical and legal dimension) in order assess the feasibility of AI:

- 1. Develop and test specialist use cases

- 2. Determine your business value

- 3. Data and model check: model test and data maturity

- 4. Assess compliance

Objective: Assessed use cases for an XAI that allows us to derive actions in the form of requirements.