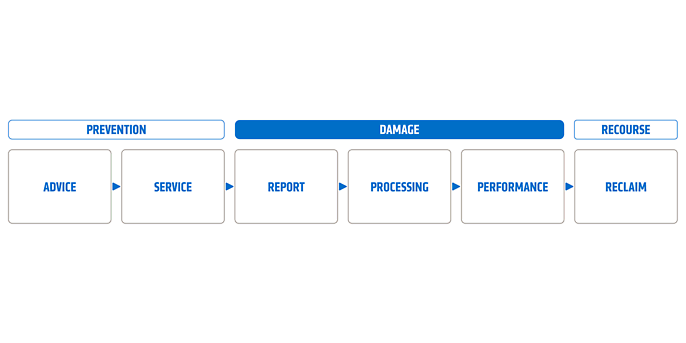

Setting up a structured claims management process with orchestrated workflows all the way from claim notification to settlement is still a major challenge for many insurers. adesso adds a new dimension by addressing the question of how an insurance company can conduct active claims management.

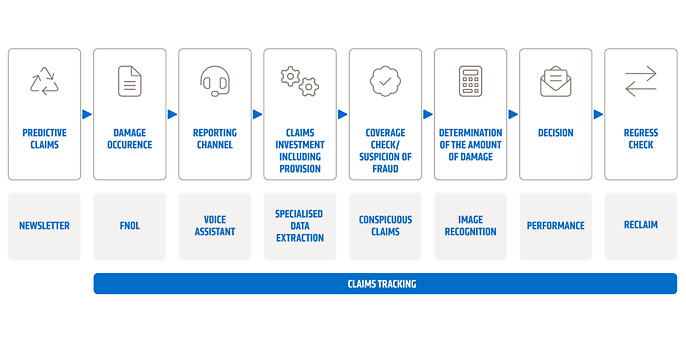

When it comes to employing various AI technologies along the claims value chain – for instance, voice assistants for simplified claims reporting, specialised data extraction for rapid evaluation of cost estimates and appraisals, image recognition for determining the extent of damage, fraud detection for fraud prevention, and so on – predictive claims is a central component. Examples of loss prevention include newsletters or push messages. The focus here is on acting instead of reacting.

Another key component of an insurer's active claims management is the recourse check. This systematically pursues opportunities to recover claims costs from responsible third parties, such as tradesmen. Effective recourse management requires the precise identification of potential recourse options and a careful assessment of their chances of success. By using modern technologies, insurers can more accurately determine the liability of third parties and substantiate their claims. The seamless integration of the subrogation check into the entire claims value chain enables insurance companies to reduce claims costs and increase their profitability.