19. May 2025 By Amir Lettgen and Mohamed Hmaid

Data-driven insurance & AI: Customer service of the future

Customers have high expectations of digital customer service

Today's customers expect their queries to be answered quickly, accurately, and competently, regardless of the channel they use—whether email, chat, or phone. At the same time, insurers face the challenge of efficiently processing increasing amounts of data, complying with strict regulatory requirements, and providing excellent customer service.

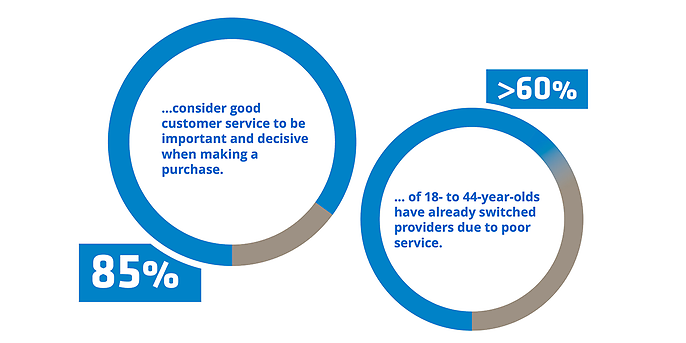

The “Customer Service in Germany” study shows that 85 percent of customers rate good service as important and decisive for their purchasing decisions. They expect quick and easy solutions to their concerns. However, long waiting times and inefficient processes often lead to frustration. Over 60 percent of 18- to 44-year-olds have already switched providers due to poor service.

Artificial intelligence is already a game changer here: intelligent automation optimizes processes, drastically reduces waiting times, and creates personalized service experiences. AI-supported systems analyze incoming inquiries in real time, categorize them automatically, and forward them to the right departments. Standard inquiries can be answered directly, while complex issues are forwarded to specialist departments with priority.

The combination of efficiency, compliance, and personalized service makes the use of AI a key success factor for the insurance industry.

AI-supported CRM and automation in customer service using examples

Many customer relationship management (CRM) systems now have AI functionalities that automate processes and provide intelligent support to employees in their daily work. Here are a few examples from customer service:

1. Email clustering and automatic request processing

Effective email clustering and automated request processing enable insurers to significantly increase efficiency in customer service. Using AI-supported algorithms, incoming emails can be automatically classified, prioritized, and forwarded to the right contact persons. This reduces processing times, optimizes resource utilization, and increases customer satisfaction. The “Customer Service in Germany” study shows that 63 percent of customers expect customer service to have all relevant data available immediately. AI applications can provide this data quickly and efficiently.

Machine learning is used to identify recurring patterns in customer inquiries, allowing emails to be sorted into predefined categories such as damage reports, contract changes, or general inquiries. Combined with automated text recognition, standard inquiries can be answered directly or integrated into workflow processes. For example, a system can automatically request documents, send status updates on ongoing claims, or remind customers of important deadlines.

In addition, automatic request processing ensures a consistent and fast response to customer concerns. By using AI-based response suggestions, service employees can work more efficiently and focus on complex cases. The combination of email clustering and automation not only leads to significant time savings, but also to improved service quality and higher customer satisfaction.

Request a consultation now and rethink customer service!

Would you like to future-proof your customer service with AI, automation, and data-driven processes? As an experienced digitalization partner, adesso supports insurers in implementing intelligent CRM systems, efficient input/output processes, and innovative customer interactions—from email clustering to hyper-realistic video chatbots.

Let us work with you to design your customized solution.

2. AI-optimized input and output management

Intelligent control of customer communications enables insurers to respond to inquiries more quickly and proactively submit tailored offers. An AI-supported system continuously analyzes customer data, recognizes patterns, and derives targeted measures—whether automated contract updates, reminders of upcoming renewals, or personalized insurance offers.

Artificial intelligence enables customer interactions to be evaluated in real time, allowing insurers to respond immediately to changing needs. For example, a system can recognize when a customer is looking for more information about a particular line of insurance and then display relevant offers or consulting options. In addition, predictive analytics can be used to identify potential churn risks at an early stage and counteract them with targeted measures, such as exclusive loyalty offers or individual adjustments to existing contracts.

In addition to pure offer creation, intelligent communication control also contributes to the optimization of internal processes. Automated workflows ensure that routine inquiries are processed immediately, allowing service teams to focus more on complex issues. Proactive notifications provide customers with important updates on their insurance coverage as well as recommendations for additional services based on their current circumstances—such as home contents insurance after moving house or disability insurance when starting a new job.

The combination of personalized communication, automated processing, and proactive customer communication ultimately leads to significant efficiency gains, higher customer satisfaction, and improved customer lifetime value. Insurers who rely on modern technologies for intelligent communication management can secure long-term competitive advantages and strengthen customer loyalty in the long run.

3. Hyper-realistic video chatbots as the next level of customer communication

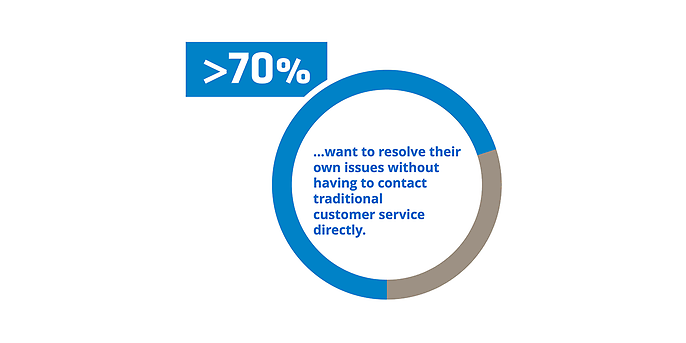

Over 70 percent of customers want to resolve their issues independently, without direct contact with customer service (study: “Customer Service in Germany”). AI chatbots and self-service portals can make this possible. Hyper-realistic video chatbots such as Vidlab7 are a particularly exciting trend in digital customer interaction. These AI-powered virtual assistants combine advanced speech processing with lifelike facial expressions and gestures, creating a whole new dimension of digital communication. While classic chatbots are often perceived as impersonal, hyper-realistic avatars create a much more natural and emotional interaction that significantly improves the customer experience.

Such video chatbots offer enormous potential for insurance companies: they enable them to offer customers a more personalized and interactive consulting experience without the need for human advisors to be available around the clock. Whether providing support for claims, answering complex contract questions, or offering personalized product advice, these virtual assistants can make communication more efficient while improving service quality. By integrating them into existing systems, they can also access individual customer profiles and suggest tailor-made solutions.

Another advantage is scalability: while human advisors can only handle a limited number of inquiries at a time, AI-powered video chatbots are available around the clock and can handle an unlimited number of customer conversations simultaneously. This not only ensures faster processing of requests, but also reduces waiting times and improves overall customer satisfaction.

The combination of artificial intelligence, realistic presentation, and personalized advice makes hyper-realistic video chatbots a forward-looking tool for insurers to optimize customer service and create an innovative, digital customer experience.

While AI has long been used primarily to automate processes in the insurance industry, the focus is increasingly shifting toward hyper-personalization. Modern AI models enable in-depth analysis of customer data, allowing insurers to understand individual needs even more precisely and address them in a targeted manner. Instead of general offers, the focus is on tailor-made solutions based on behavioral patterns, contract data, and external factors.

A key advantage of this development is the ability to not only respond to customer inquiries, but also to proactively make suggestions. For example, AI can use past customer behavior to figure out which insurance products might be relevant and offer them at just the right time. This means personalized rate quotes can be generated automatically without the customer having to do anything.

AI-supported automation is also revolutionizing service in claims management: real-time analyses not only enable claims to be identified more quickly, but also processed and settled directly. Customers receive feedback on their case within a very short time, including a forecast of the expected processing time or direct payment in clearly defined claims cases.

The future of the insurance industry therefore lies in a combination of intelligent automation and personalized services. While processes run more efficiently in the background, customers benefit from individually tailored support. In the future, AI systems will not only react, but actively respond to customer needs – a customer experience with a wow effect.

Our solution for the insurance industry

As a leading partner for digital transformation, we support you in implementing a modern, AI-supported CRM system. With our expertise in automation, machine learning, and process optimization, we help you make your customer service fit for the future.

Optimize your customer management with ADITO and adesso

Benefit from ADITO, the innovative CRM solution from adesso that is perfectly tailored to your needs. Increase your efficiency, improve customer loyalty, and make data-driven decisions—all with a single, flexible platform.