29. October 2025 By Sandra Weis

Adjustment of the contribution assessment ceiling (BBG) in 2026

Impact on occupational pension schemes

Under Section 1a of the Occupational Pensions Act (BetrAVG), employees have the right to convert part of their future salary into contributions to an occupational pension scheme. Specifically, up to four per cent of the applicable contribution assessment ceiling (BBG) in the statutory pension insurance scheme can be used for this purpose. The aim of this regulation is to enable employees to make additional provisions for old age and thus reduce the risk of poverty in old age. As the BBG is adjusted annually, the maximum tax-subsidised contribution amounts also change.

On 9 September 2025, the Federal Ministry of Labour and Social Affairs published the draft bill for the Social Security Calculation Parameters Regulation 2026. This provides for an increase in the BBG. Following consultation in the Federal Cabinet, where no significant changes are expected, the Federal Council still has to give its approval. Experience shows that this approval is a mere formality. The entry into force of the new values will have a direct impact on occupational pension schemes.

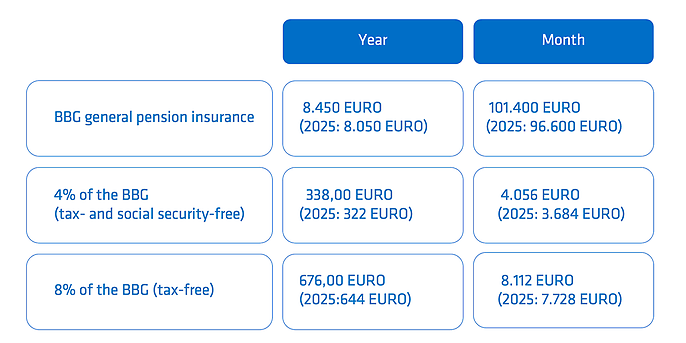

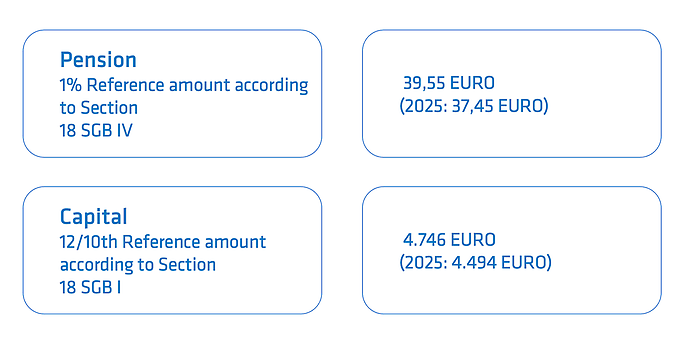

Expected calculation parameters for occupational pension schemes in 2026

Since 2025, uniform limits have applied in eastern and western Germany for pension and unemployment insurance. However, the reference value relevant for de minimis limits remains different in the east and west.

According to Section 3 (2) in conjunction with Section 18 of the Occupational Pensions Act (BetrAVG), employers may pay out small, already vested entitlements without the consent of the employee, provided that these are below a specified de minimis limit. Further adjustments to these values are planned for 2026.

Consequences of raising the contribution assessment ceiling for occupational pension schemes

Occupational pension schemes are considered an attractive additional benefit that benefits employees and at the same time helps companies retain skilled workers in the long term. A key advantage is the tax- and social security contribution-free contributions, which are subsidised up to four per cent of the applicable contribution assessment ceiling (BBG).

If the BBG increases, the maximum eligible amounts also change – which can have a significant impact on the existing system.

Impact on employees

The increase in the BBG means that employees will in future be able to contribute a larger portion of their salary to occupational pension schemes with tax and social security benefits. Employers must contribute an additional 15 per cent of the converted amount. However, this only applies if they themselves save on social security contributions. As the subsidy is calculated as a percentage, it increases as the conversion amount rises. This regulation has also applied to existing contracts since 2022. It will lead to an increase in future pension benefits. This may reduce or even completely avoid pension gaps.

Digital services for occupational pension schemes

Occupational pension schemes are among the most complex areas of insurance. At adesso, we turn this challenge into an opportunity: with intelligent interfaces, automated processes and seamless integration, we create added value for insurers, employers and employees alike. This makes occupational pension schemes more transparent, user-friendly and economical.

Impact on employers

The increase in the contribution assessment ceiling affects not only employee contributions, but also the mandatory employer subsidy. Particularly in contracts that are automatically linked to the BBG, the new ceiling also increases the company's subsidy. Employers must therefore adjust their payroll accounting accordingly and ensure that the higher total contributions are forwarded to insurers or pension funds in a timely manner.

Impact on insurers and pension providers

Insurance companies and pension providers often face the difficulty that their administrative systems have technical limitations. This is particularly evident in contracts with flexible contribution levels, in which employer contributions are also part of the insurance relationship. If the amounts paid exceed the maximum tax- and social security-free amount, providers must respond. They need suitable procedures to properly record and process these additional amounts. This is a complex task that requires precise solutions.

Need for information and communication

With an increase in the contribution assessment ceiling, the effort required for information and coordination also grows. Employers, employees and insurers alike need to be informed about the changes at an early stage and in a comprehensive manner. It is important to choose appropriate communication channels and to convey content in a clear, understandable and comprehensible manner. For practical implementation, it is also advisable to design technical systems to be flexible enough to easily accommodate not only the current adjustment but also future changes to the BBG.

The solution

The adjustment of the contribution assessment ceiling poses organisational and technical challenges for all parties involved – employees, employers, insurance companies and pension providers. However, with forward planning and suitable IT solutions, the new requirements can be efficiently managed.

Especially in the case of larger companies or complex contractual constellations, it may be advisable to involve specialised IT service providers. They ensure that legal requirements are met and help to adapt accounting and administration systems so that changes to the BBG are automatically taken into account. In addition, they can also help to develop a clear communication concept in order to inform all parties involved about the changes in a transparent manner.

We support you!

The Occupational Pension Strengthening Act (BRSG) brings opportunities and obligations for all parties involved. For many, this means greater complexity, more effort and new adjustments. This is exactly where our digital solutions come in, making your occupational pension processes lean, automated and legally compliant.