PSD2 offers insurers regular contact with customer

Third-party providers that hold a PSD2 license can access the payment accounts of bank customers in order to provide account information/payment services. Insurers also benefit from this provision. This deregulation of the market and competition puts the customer first, as the account holder is free to decide who should receive account and/or payment information. This means that customers no longer have to rely solely on services provided directly by their main bank. They can now make use of apps and services from non-banking institutions, too.

PSD2 and the digital account book - new potential for the insurance industry

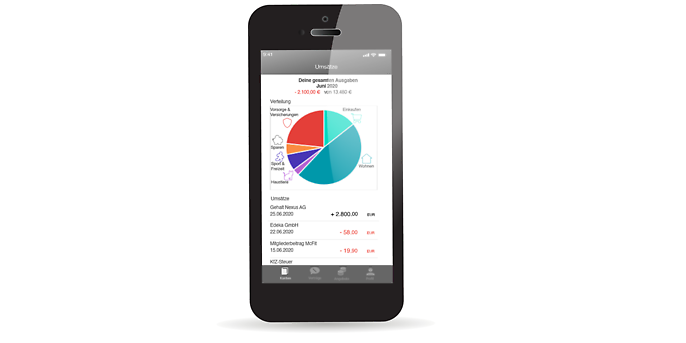

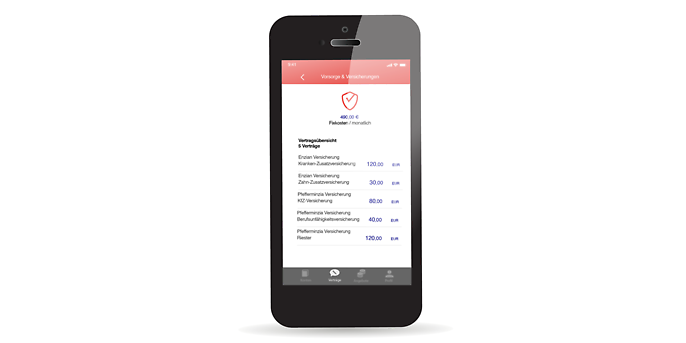

PSD2 allows account information to be examined in detail. This in turn allows insurers to get to know the customer and find out about their income and spending habits within the framework set by the regulation. This analysis serves as the foundation for a digital account book, which allows insurers to provide personalised suggestions relevant to the customer. Here we will show you how you can analyse payment flows in the insurance sector:

1. Analyse turnover and identify gaps in coverage.

The digital account book provides you with a tool for analysing and categorising the income of the insured person. If you identify coverage gaps, you can specifically point these out to the insured person.